By Justine Irish D. Tabile, Reporter

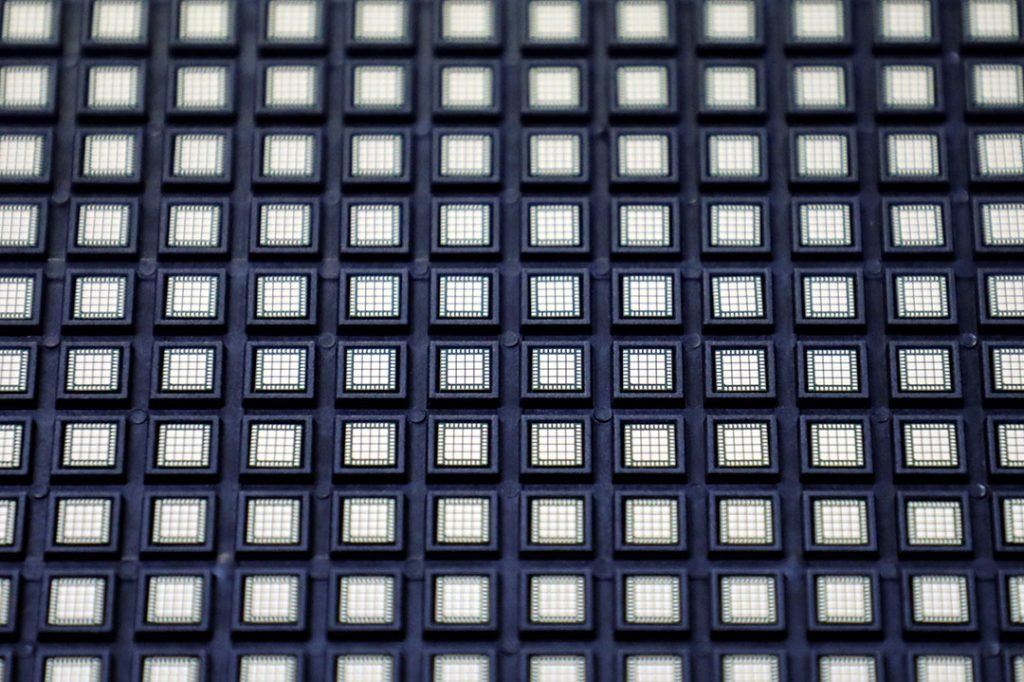

PHILIPPINE EXPORTS of semiconductor and electronic products are likely to be flat in 2025 amid a slump in demand, the Semiconductor and Electronics Industries in the Philippines Foundation, Inc. (SEIPI) said.

SEIPI President Danilo C. Lachica said the board affirmed its earlier projection of a 10% decline in semiconductor and electronics exports this year.

“We just finished our board meeting last week. The 10% contraction forecast for 2024 is the same, while exports in 2025 are flat,” he said in a Viber message on Monday.

Mr. Lachica said exports will likely be flat in 2025 as the semiconductor and electronics industry is being affected by a “tough business environment and low demand.”

Exports of electronic products accounted for 55% of the Philippines’ total exports of $55.67 billion in the January-to-September period.

In the first nine months, the Philippines exported $30.6 billion worth of electronic products, falling 2.2% from the $31.28 billion a year ago amid soft demand.

Sought for comment, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said that the expected protectionist policies of US President-elect Donald J. Trump and trade wars could affect Philippine exports, including electronic products.

“Trump protectionist policies could lead to higher tariffs, and trade wars could slow down global trade and global economic or business activities,” said Mr. Ricafort in a Viber message.

In a report dated Nov. 25, GlobalSource country analysts Diwa C. Guinigundo and Wilhelmina C. Mañalac said that Mr. Trump’s plan of imposing 60% tariffs on Chinese goods and up to 20% tariffs on goods from other countries could hurt the Philippines’ exports to the US.

“The US is a major destination for Philippine exports, making up an average of about 16% of total export trade for the last five years,” the analysts said.

“While the share-to-total has slightly declined due to the trade diversification policy of the Philippine government in recent years, a further drop in exports to the US definitely does not bode well for the country,” they added.

Previously, Mr. Lachica said that the country will need more investments to improve its exports mix and make it more globally competitive.

“One of the comments I heard when we were in the US is that the Philippines fell asleep as far as the semiconductor and electronics industry is concerned, referring to the previous administrations,” he said in a panel discussion at the National Exporters Week on Dec. 4.

“In fact, we have significant capital flights from the electronics industry because of the incentive rationalization,” he added.

Mr. Lachica said the “good news” is that the Marcos administration is fixing the issues on incentive rationalization through the Corporate Recovery and Tax Incentives for Enterprises to Maximize Opportunities for Reinvigorating the Economy (CREATE MORE).

Mr. Marcos last month signed the Republic Act No. 12066 or CREATE MORE Act, which seeks to improve the country’s fiscal incentives policies.

The CREATE MORE Act extended the maximum duration of availment of tax incentives to 27 years from 17 years, as well as reduced corporate income tax for registered business enterprises.

Mr. Lachica said he recognized the government’s efforts to reduce the cost of power and logistics through the Luzon Economic Corridor.

The Luzon Economic Corridor is being undertaken via a trilateral agreement among the Philippines, US and Japan. It is part of a broader collaboration supported by the G7 Partnership for Global Infrastructure and Investment.

“So, we are very optimistic, at least from the industry perspective, to announce that the Philippines is back,” he said. “Of course there are some other issues that we need to face. But the ease of doing business has improved, the infrastructure is improving, and power is improving, so I think it is really a call to action [for our partners] to reconsider the Philippines.”