The Bank of England is widely expected to keep interest rates on hold on Thursday after the latest UK inflation figures remained stubbornly high.

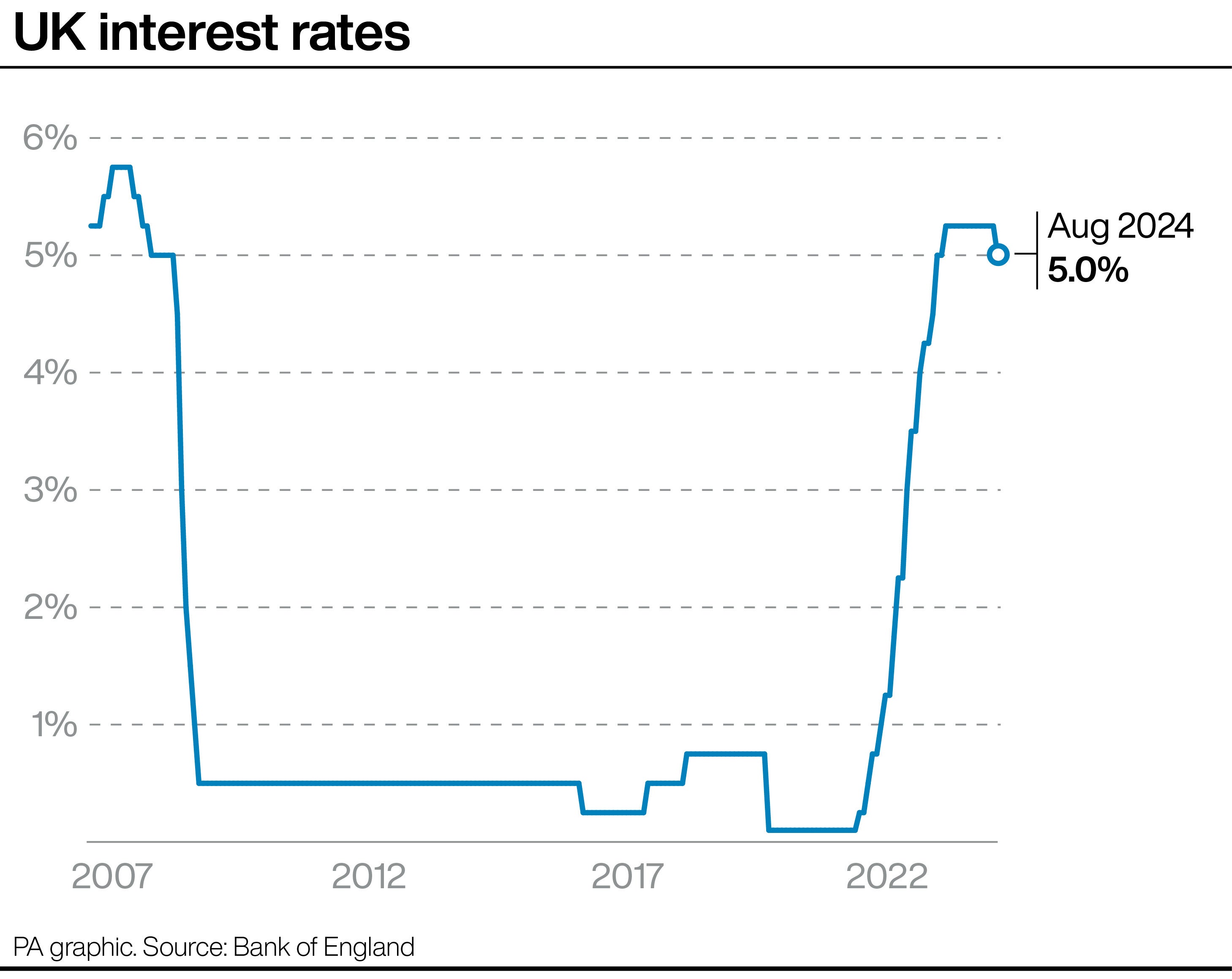

Most economists think the rate-setters on the Bank’s Monetary Policy Committee (MPC) will keep the base rate unchanged at 5 per cent, a level which – prior to last year – had last been seen in 2008 during the global financial crisis.

The Bank cut rates from 5.25 per cent last month – the first reduction since 2020, in a move welcomed by squeezed borrowers still suffering from the cost-of-living crisis. The move disappointed savers, however.

Bank of England governor Andrew Bailey said it had been able to cut the base rate because inflationary pressures had “eased enough”.

August’s inflation was unchanged at 2.2 per cent, which was higher than the Bank of England’s 2 per cent target but was below the 2.4 per cent the Bank itself had predicted at this stage.

Keeping the base rate on hold means mortgage repayments are unlikely to change.

The Bank of England’s rate-setters could take note of the European Central Bank’s (ECB) decision to cut interest rates in the Eurozone last week, marking the second reduction in a row.

The ECB’s rate-setting council lowered the main deposit rate from 3.75 per cent to 3.5 per cent at the meeting last week.

Andy Gregory19 September 2024 08:14

“Instead, the MPC will likely take this as a positive sign that underlying price pressures are easing, and could warrant a further dial down of restrictive policy in November, when it conducts its next forecast update,” he said.

“The MPC will also have more information on the fiscal outlook, with the autumn Budget slated for 30 October.”

Andy Gregory19 September 2024 07:57

Matt Swannell, chief economic adviser at the EY Item Club, said the Bank of England had“sent a clear message that back-to-back rate cuts were unlikely” after last month’s reduction, unless subsequent economic data was weaker than expected.

He said the latest official data, which showed Consumer Prices Index (CPI) inflation remained at 2.2 per cent in August, would not be enough to prompt the Bank to start cutting rates more quickly.

Andy Gregory19 September 2024 07:44

Joe Middleton19 September 2024 07:18

Hi and welcome to our blog covering the Bank of England’s latest decision on interest rates that will happen at midday. We will bring you all the latest on the decision as well as reaction from top economists and policymakers.

Joe Middleton19 September 2024 07:08

Annual house price growth has slowed, but private rents continue to climb at a “near-record rate”, according to an Office for National Statistics (ONS) report – as many hard-pressed borrowers know:

Jane Dalton19 September 2024 07:00

Savers are an estimated £4billion better off following improvements to easy-access rates in recent months, according to the City regulator.

The Financial Conduct Authority (FCA) said the average interest paid on easy-access savings accounts increased to 2.11% in June, up from 1.66% in July 2023, just before it published a review.

It said: “We estimate savers are £4 billion a year better off from higher interest rates as a result.”

A new consumer duty was introduced by the regulator last year, requiring financial firms to put consumers at the heart of what they do, including when designing products and communicating with customers.

In July 2023, the FCA also set out a 14-point action plan to ensure banks and building societies were passing on interest rate rises to savers appropriately, that they were communicating with customers more effectively and that they were offering them better savings rate deals.

The FCA said that while interest rates on savings accounts had been rising, this had been happening more slowly for easy-access accounts.

Jane Dalton19 September 2024 04:15

Examples of how everyday costs changed:

Jane Dalton19 September 2024 03:00

The Bank of England is expected hit the pause button on interest rate cuts after warning it needs to be “careful” not to rush the decision as pressures on inflation linger:

Jane Dalton19 September 2024 01:30

European Central Bank opt for consecutive rate cuts

Inflation figures won’t be enough to trigger rate cut, economist forecasts

Back-to-back cuts unlikely, analyst says

How UK interest rates have changed since 2007

Good morning

House price growth slows but rents climb at near-record rate

Savers £4bn better off thanks to higher easy-access rates

How inflation has accelerated or eased for everyday items

MPC set to put interest rate cuts on hold