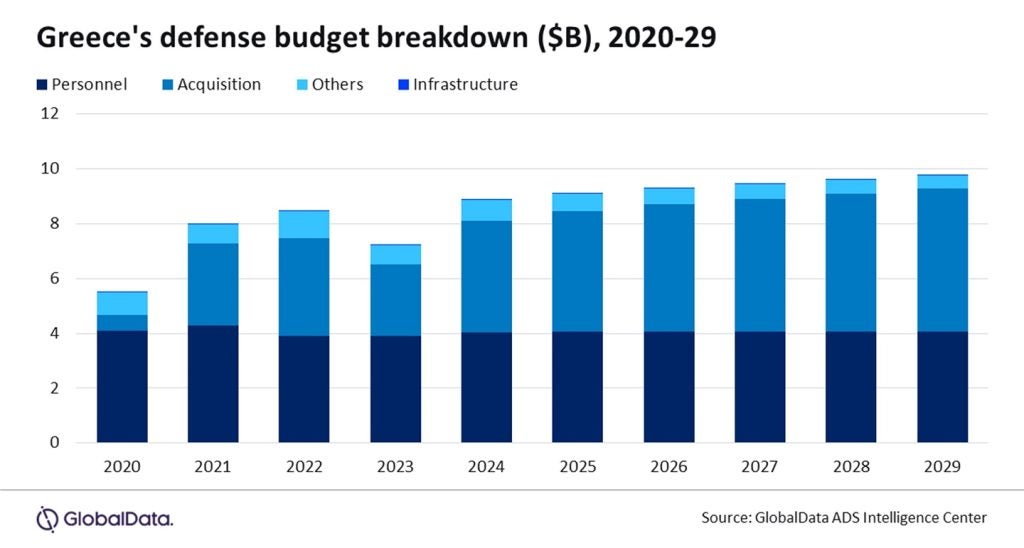

GlobalData’s “Greece Defense Market 2024-2029” report projects Greece’s defence spending to grow, though it will fall short of Nato’s 2% GDP target.

Greece’s defence budget is forecast to increase steadily over the next five years, reaching $9.8bn (€8.7bn) by 2029, according to the latest report by GlobalData, a leading data and analytics company. While the projected growth signals increased investment, it also reveals Greece’s continued struggle to meet Nato’s spending benchmark due to persistent economic constraints and political divisions.

The report, titled “Greece Defense Market 2024-2029“, highlights key trends, including a boost to Greece’s acquisition budget and the stabilisation of personnel costs, driven by the country’s large military forces and conscription system. This dynamic will shape the defence landscape in Greece, with implications for both domestic and international defence contractors.

Acquisition growth to lead defence spending

The GlobalData report reveals that Greece’s defence budget, which stood at $5.5bn in 2020, is set to rise by more than 75% over the next decade, with acquisitions making up a significant portion of this increase. From $0.59bn in 2020, the acquisition budget will soar to $5.22bn by 2029, signalling the government’s commitment to modernising its military platforms across all domains—air, land, and sea.

Wilson Jones, Defence Analyst at GlobalData, notes, “The largest section of Greece’s budget has historically been personnel costs, which have remained just over $4bn annually due to Greece’s large military forces of over 200,000. However, the real shift is in acquisition, reflecting the government’s focus on platform modernisation.”

This stream of acquisition spending will be instrumental in strengthening Greece’s defence industrial base. Many platforms are produced domestically or through offset agreements. This is expected to maintain a workforce in the Greek defence sector while also benefiting international defence contractors involved in the production and delivery of systems.

Access the most comprehensive Company Profiles

on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Company Profile – free

sample

Your download email will arrive shortly

We are confident about the

unique

quality of our Company Profiles. However, we want you to make the most

beneficial

decision for your business, so we offer a free sample that you can download by

submitting the below form

By GlobalData

Key modernisation programmes drive investments

Several modernisation programmes underpin Greece’s defence investments. Among these is the acquisition of 24 Rafale fighter aircraft from France, aimed at replacing the ageing Mirage 2000 fleet. Additionally, Greece recently joined the F-35 Lightning II global alliance by signing a Letter of Offer and Acceptance (LOA) for 20 F-35 fighter jets, with an option for 20 more. Together with the Rafale programme, this will enhance the country’s aerial capabilities.

On the naval front, Greece is strengthening its maritime defence by procuring four new multi-purpose frigates and modernising four MEKO-class frigates. Greece will also acquire four MH-60R Seahawk helicopters, with the option to purchase additional units in the future.

These acquisitions are complemented by investments in land forces, including anti-tank weapons, guided missiles, and heavy torpedoes. Greece has also committed to expanding its unmanned aerial vehicle (UAV) capabilities, with UAVs set to play roles in reconnaissance and attack operations.

Jones explains, “The combination of advanced aircraft acquisitions, naval upgrades, and increased UAV capabilities will act as force multipliers, significantly enhancing Greece’s defence posture, particularly in the Aegean Sea, where tensions with Turkey remain high.”

Balancing economic challenges and needs

Despite these advancements, Greece faces economic and political headwinds that could hinder its ability to meet long-term defence goals. The country’s defence spending as a percentage of GDP is expected to remain in the mid-1% range through 2029, falling short of NATO’s 2% target. This shortfall reflects the problematic balance between economic recovery and domestic political pressures.

This isn’t an isolated issue, as Mediterranean neighbour Spain also seeks to align with Nato’s 2% GDP defence spending target.

This means opportunities may be concentrated in specific programmes, particularly acquisition and modernisation, for defence contractors, both local and international. However, political uncertainties and budget constraints could lead to delays or adjustments in procurement schedules.

Implications for the defence industry

The focus on domestic production and technology transfer presents opportunities for collaboration between Greek firms and international defence companies. With Greece prioritising self-reliance and industrial growth, foreign partners may benefit from joint ventures or offset arrangements that help meet Greece’s military modernisation needs while aligning with local industrial policies.

Jones concludes, “Greece’s growing defence commitments, coupled with stable population figures and a rise in GDP, will allow for increased spending per capita. This will translate into a continued focus on acquisitions, although the industry must remain vigilant to potential risks stemming from economic and political volatility.”