UK house prices reached a new record average high in January of nearly £300,000, according to Halifax.

The average property price was £299,138 as house prices increased by 0.7 per cent month-on-month.

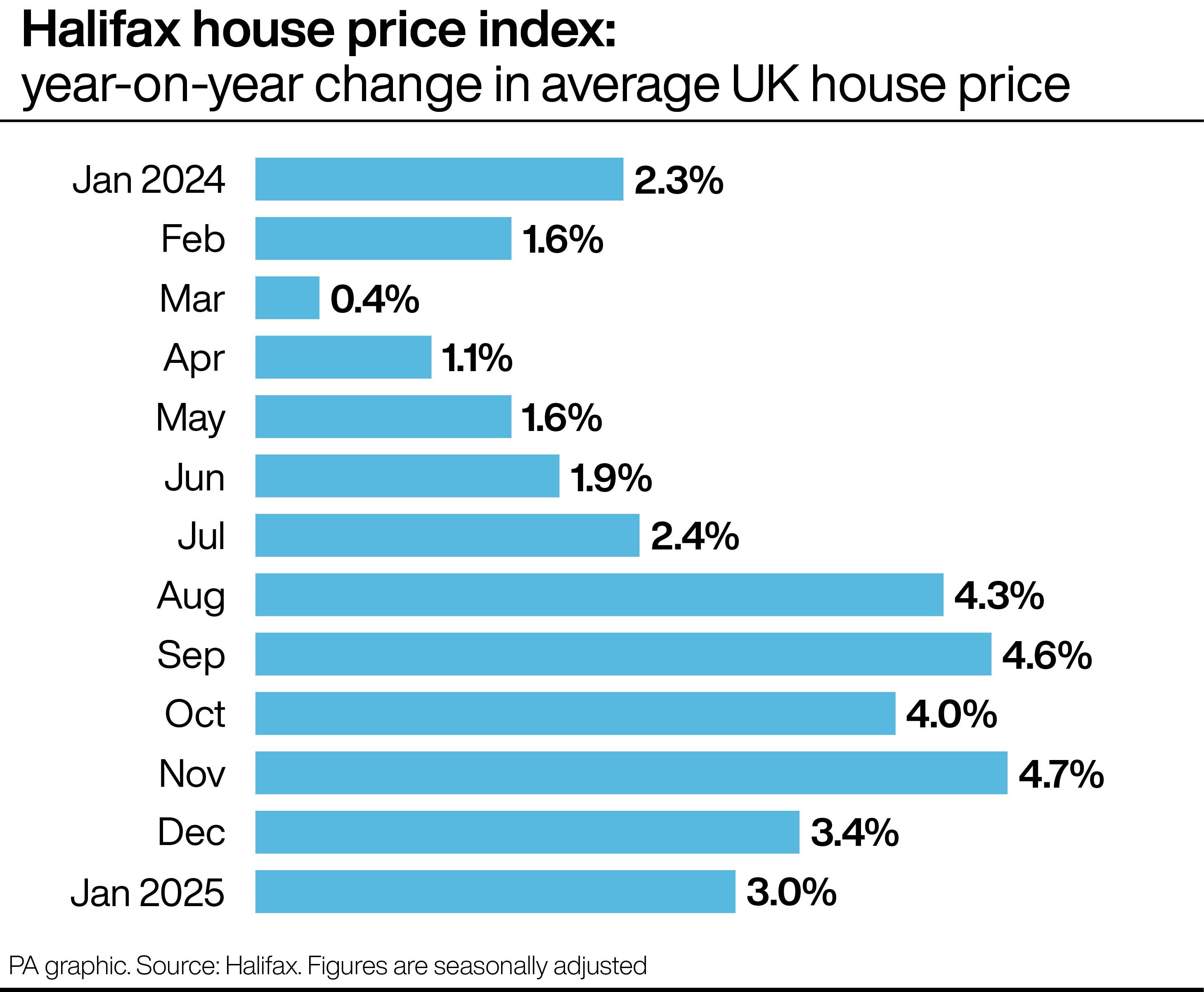

While house prices may have increased, annual growth slowed to three per cent, which is the slowest rate since July 2024.

This growth shows recovery following a market-wide decrease in December, as house prices fell by 0.2 per cent.

Halifax’s head of mortgages, Amanda Bryden, said this was a “positive note” as average prices “more than” recovered from the slight dip in December.

She added: “Affordability is still a challenge for many would-be buyers, but the market’s resilience is noteworthy.”

Ms Bryden remarked there was a “strong demand” for new mortgages and growth in lending.

“With a stamp duty increase looming, some of this demand may have come from first-time buyers eager to complete transactions before the end of March,” she said.

“Despite geopolitical uncertainties and waning consumer confidence, other key indicators look fairly positive for the housing market.”

Ms Bryden cited the Bank of England’s first base rate cut of the year and the expectation that household earnings will continue to beat inflation as signs the financial pressure from the cost-of-living squeeze was easing up.

She predicted mortgage rates would hover between four per cent and five per cent in 2025, “influenced by both global financial markets and domestic monetary policy”.

She added: “Over the past year, buyers have been getting used to this new normal, understanding that rates are unlikely to return to the historical lows of 1%.”

Ms Bryden remarked the fundamental issue remained a lack of supply within the housing market, but along with a “gradual improvement in affordability”, she predicted a modest house price growth over the year.

This is a breaking news story. More to follow…